Welcome

Now Reading 1 of 5

Action Learning

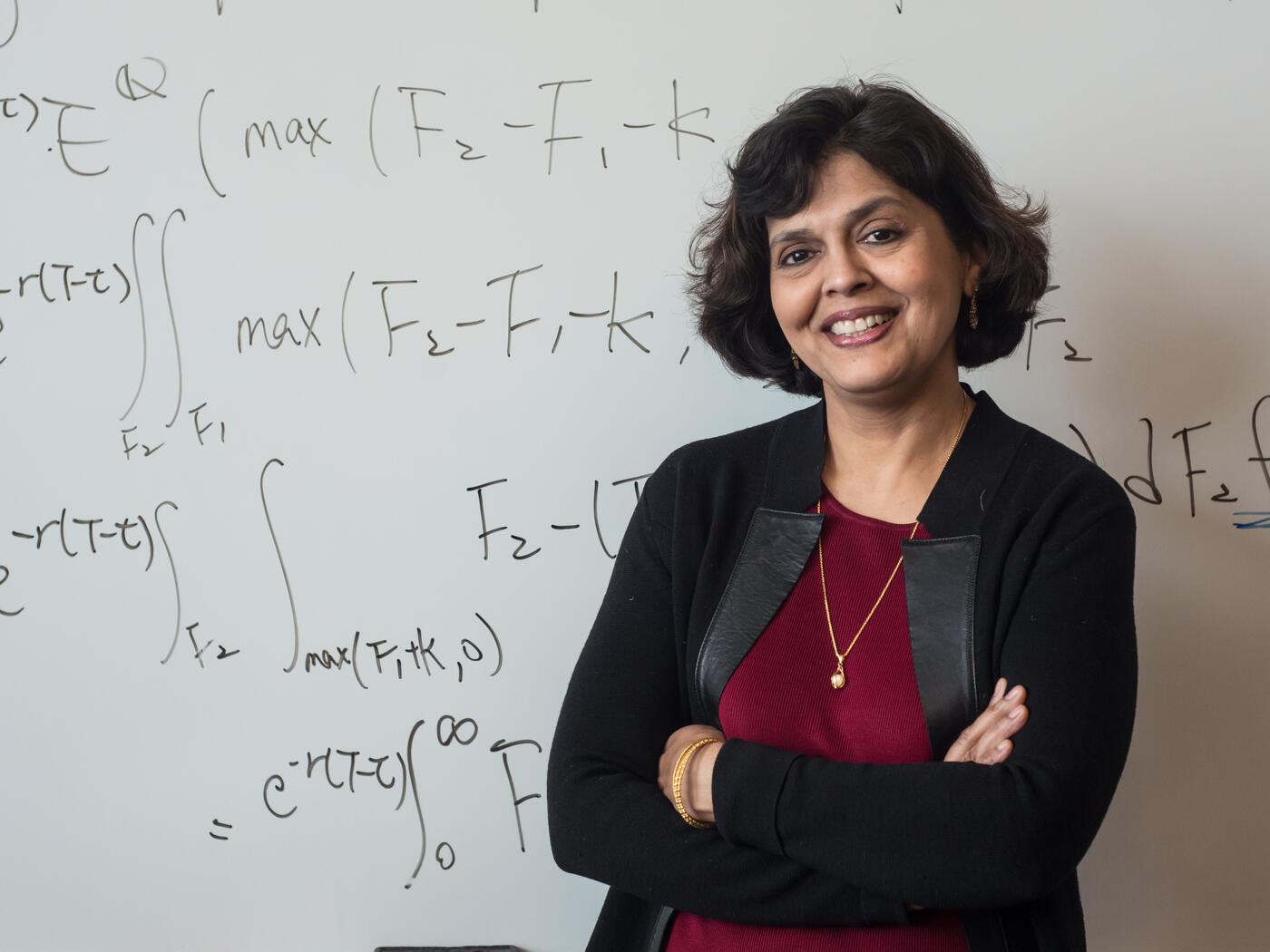

FACULTY SPOTLIGHT: Favorite MBA professors of the class of 2020

This year's MBAs share their favorite professors.

Learn MoreFinance Lab Poster Session.

15.453 Finance Lab

The Finance Lab (Fin-Lab) is a graduate-level course providing immersive learning for MIT Master of Finance students, MBA students, and others who have completed the prerequisites. In this course, students work in teams on substantive projects proposed by external hosts. Our goal is to provide students with a meaningful opportunity to partner with leading industry practitioners on important topical finance problems, while helping them to bridge the gap between theory and practice, and introducing them to the broader financial community. The course is full-time during the month of January, and includes some preparation and follow-up before and after the full-time experience.

Through our Finance Lab project, our team helped a climate-focused, early-stage venture capital firm update its deal flow evaluation playbook based on the potential incentives for startups from the Inflation Reduction Act. It was great to learn in depth how finance, policy and business can intersect to drive climate impact from the ground up!